Loading...

A smarter way to find and manage income options

Find Your Next Trade

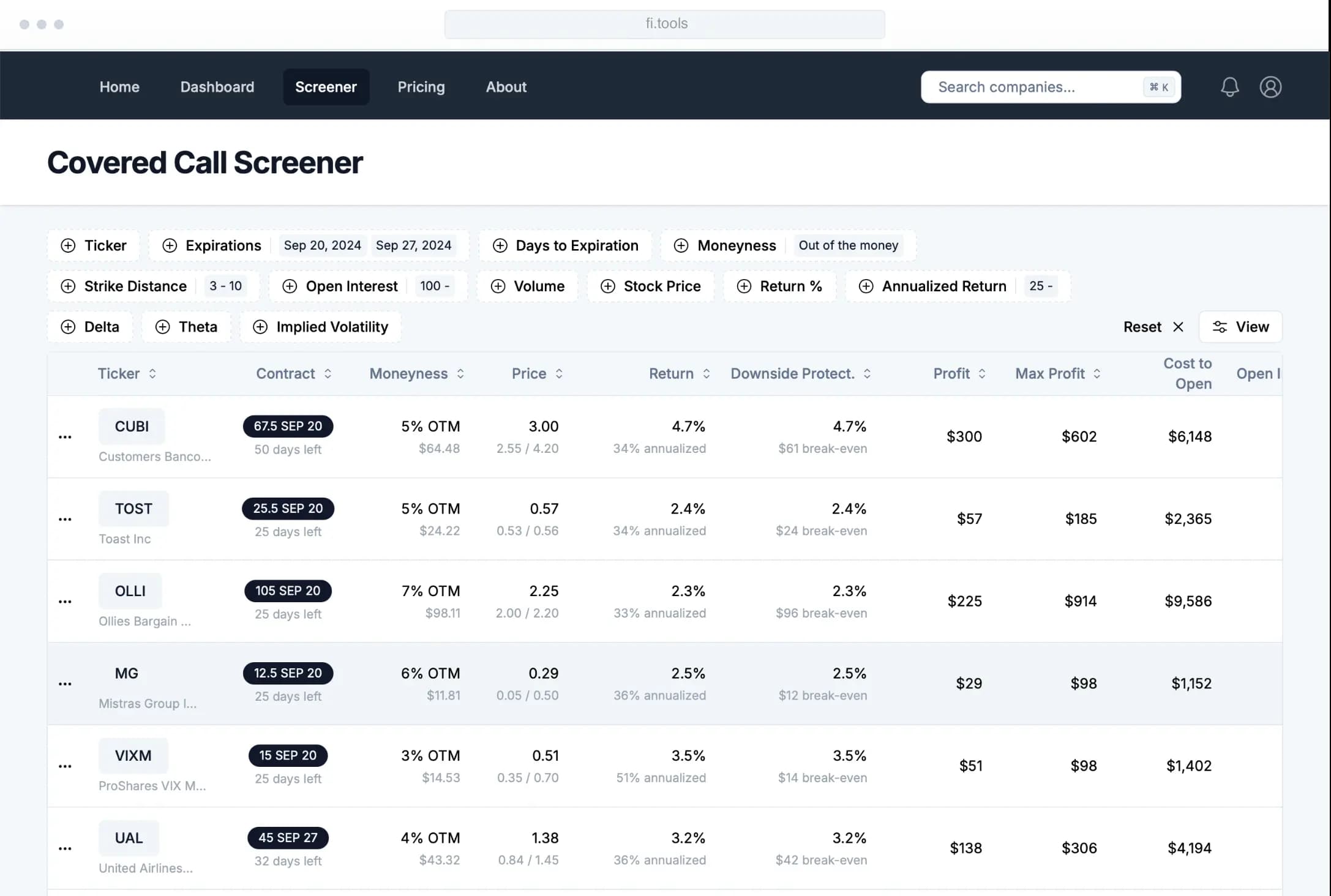

Powerful Options Screener

Filter covered calls and cash-secured puts by expiration, moneyness, open interest, IV, and more. Find opportunities that match your exact criteria.

- Advanced Filtering

- Filter by expiration dates, strike prices, and moneyness to find the perfect opportunities.

- Smart Search

- Quickly search through thousands of options to find the ones that match your criteria.

- Performance Analytics

- Track historical performance and analyze potential returns with detailed metrics.

Smart Portfolio Management

Income Options Investing, Simplified

Say goodbye to spreadsheet sprawl and manual calculations. Our intuitive tools help you quickly find covered calls and cash-secured puts, track your trades, and evaluate potential adjustments.

- Trade Idea Generation

Let our intelligent screeners do the heavy lifting for you. Input your preferences and let the tool surface covered calls and cash-secured puts that align with your investment goals and risk tolerance.

- Portfolio Monitoring

Effortlessly manage your income options portfolio with our comprehensive tracking tools. Monitor your positions, track expiration dates, and view critical metrics like potential profit and loss.

- Dynamic Pricing Insights

With pricing data that updates throughout the trading day, you can efficiently manage your positions. Identify opportunities to adjust or close trades based on current market conditions.

Optimize Your Rolls

Smart Rolling Calculator

When a position moves against you or you want to roll it forward, our rolling calculator helps you assess your options. Make informed decisions about managing your positions.

- Smart Roll Analysis

- Instantly analyze potential roll opportunities with our advanced calculator that considers all market conditions.

- Profit Optimization

- Compare different strike prices and expiration dates to maximize your potential returns.

- Cost Analysis

- Get detailed breakdowns of transaction costs and potential profits for each rolling scenario.

Frequently asked questions

Why Income Options

Accelerate Your Path to Financial Independence

At FI Tools, we empower experienced investors to generate consistent cash flow through covered calls and cash-secured puts. These strategies aren't about chasing explosive gains—they're about creating reliable income streams from your existing portfolio, regardless of market conditions.

While income options strategies are powerful tools for income generation, they're most effective for investors with established portfolios seeking to optimize returns. If you're still in the wealth accumulation phase, traditional buy-and-hold strategies may better serve your goals.

Key advantages for seasoned investors:

- Income Generation

- Generate consistent income in any market condition through time-tested options strategies.

- Portfolio Enhancement

- Optimize returns on your existing portfolio by converting stock holdings into reliable income streams.

- Strategic Flexibility

- Adapt your strategy to market conditions with adjustable strike prices and expiration dates.

- Risk Management

- Maintain a conservative approach while potentially reducing portfolio volatility through premium collection.

Join the waitlist to be first to know when we launch. Our tools are designed to help you execute and manage income options strategies with precision and confidence.